The global date industry has evolved into one of the most significant agricultural trade sectors, bridging tradition with modern consumer demand. As both a staple food and a premium health product, dates have become an increasingly valuable commodity in international markets. Today, the economic value of date exports extends far beyond simple trade numbers—it encompasses rural employment, sustainable farming practices, global food security, and cultural heritage. According to recent market studies, the global dates market was valued at over USD 31 billion in 2024 and is expected to surpass USD 49 billion by 2032, reflecting strong demand growth across Europe, Asia, and North America. For producing countries such as Saudi Arabia, Iran, the UAE, and North African nations, dates represent not only a source of export revenue but also a strategic agricultural asset. Understanding the economic impact of date exports requires a comprehensive overview of trade trends, competitiveness factors, policy frameworks, and future opportunities in a rapidly changing global marketplace.

Introduction: Why Date Exports Matter in the Global Economy

Iranian Dates represent more than just an agricultural product; they are a cornerstone of trade, culture, and nutrition across the globe. With centuries of cultivation history, dates have become a strategic commodity in international markets, generating billions of dollars in revenue annually. Their growing importance lies not only in meeting consumer demand for natural and nutrient-rich foods but also in creating economic opportunities for producing nations. As global trade expands, dates are increasingly recognized as a vital export crop that connects traditional farming practices with modern dietary trends, making them a key player in the global economy.

Global Trade Trends & Market Size: What the Data Shows

In recent years, international demand for dates has surged, driven by consumer preferences for healthy and natural sweeteners. The global dates market, currently valued at over USD 31 billion, is projected to exceed USD 49 billion by 2032, highlighting the strength of this sector. Iranian date varieties, including Mazafati, Piarom, and Kabkab, play a major role in this trade landscape, with Iran consistently ranking among the top global exporters. Meanwhile, countries such as Saudi Arabia and the UAE have also expanded their export volumes, competing in both traditional and emerging markets. This dynamic growth underscores the need for producers to enhance competitiveness by improving quality, branding, and market access strategies.

Key Determinants of Export Competitiveness in Date Markets

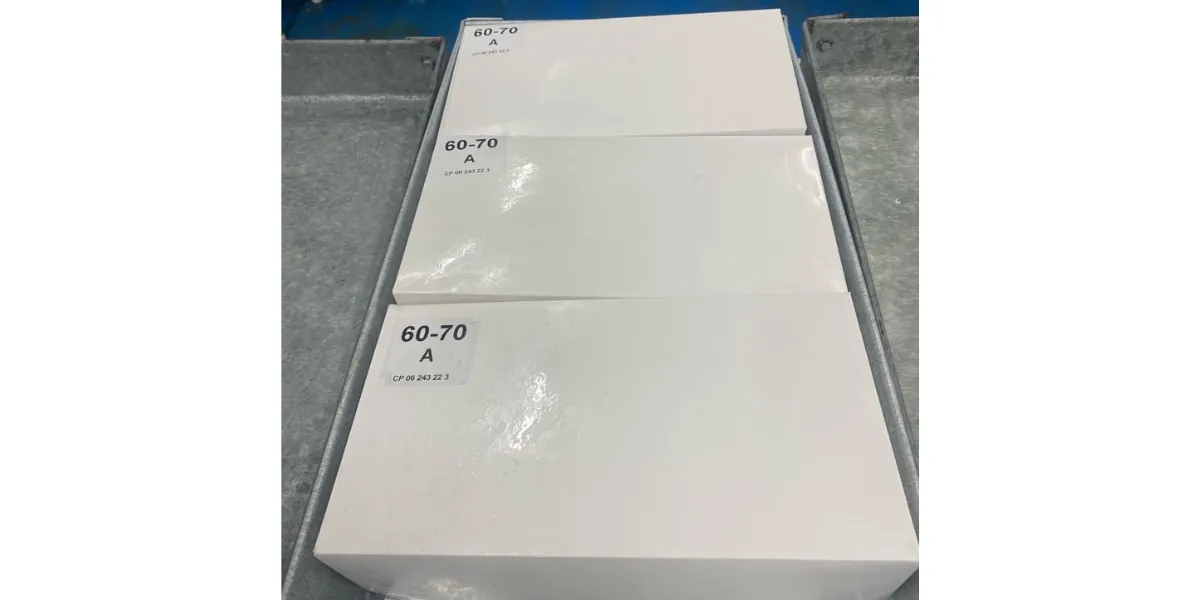

The value of date exports depends heavily on factors that shape competitiveness, from cultivation techniques to international standards. Quality assurance, proper grading, and advanced packaging play decisive roles in winning consumer trust across high-value markets in Europe, Asia, and North America. Equally important are certifications such as organic labeling and traceability, which increase consumer confidence. Beyond logistics and policy, the rising global awareness of the Health benefits of dates provides producers with a unique opportunity to position their products not only as traditional foods but also as functional and wellness-oriented commodities. This perception elevates demand and opens pathways to premium pricing in health-conscious markets.

Economic Impacts for Producing Countries

For producing nations, date exports are far more than a source of foreign exchange—they are a catalyst for rural development, employment, and agricultural innovation. In Iran, for example, the date industry sustains thousands of farmers and workers across processing and distribution channels, supporting both local livelihoods and national economic stability. Yet competition is intensifying, as global buyers compare Iranian dates vs Medjool dates to assess differences in taste, texture, price, and availability. While Medjool dates from North Africa and the U.S. command premium segments, Iranian varieties continue to dominate in terms of diversity, affordability, and cultural heritage. Balancing these strengths with improved branding and marketing could ensure sustained economic benefits for producing countries well into the future.

Case Studies: Success Stories & Lessons Learned

Examining global case studies highlights how strategic planning can transform the date export sector into a powerful economic driver. Saudi Arabia, for example, has invested heavily in advanced cultivation techniques, post-harvest infrastructure, and global marketing campaigns. As a result, its date exports reached nearly USD 452 million in 2024, reflecting a double-digit growth rate compared to previous years. The country’s success demonstrates the importance of aligning agricultural practices with export strategies while diversifying product portfolios to appeal to international buyers. Similarly, Iran has maintained its position as one of the world’s leading exporters by leveraging the rich diversity of its date varieties, from premium Mazafati to bulk Kabkab dates. Despite facing challenges such as sanctions and fluctuating market access, Iran’s ability to consistently supply high volumes illustrates the resilience of its producers and exporters. Tunisia also provides an important lesson: by branding Deglet Noor dates as a high-quality product with strong identity, Tunisian exporters successfully penetrated European and North American markets. These success stories underscore that long-term competitiveness requires more than volume—it demands investment in branding, value-added processing, certification, and quality assurance, which together enable producers to capture higher margins and strengthen their global presence.

Forecasts: What the Future Holds for Date Exports

The future of the date export industry is shaped by both growing consumer demand and structural challenges in global agriculture. Current forecasts suggest the market will expand at a compound annual growth rate (CAGR) of over 5% between 2024 and 2032, reaching nearly USD 50 billion. Much of this growth will be fueled by increasing health awareness, as consumers in Europe, North America, and Asia seek natural sweeteners and functional foods. Dates, rich in fiber, minerals, and antioxidants, fit neatly into this global wellness trend. Technological adoption—such as smart irrigation systems, advanced drying techniques, and blockchain-based traceability—will further enhance efficiency and market trust. However, forecasts also caution about climate change risks, including water scarcity and rising temperatures, which threaten yields in traditional producing regions like the Middle East and North Africa. Another key trend is diversification, with new players such as Mexico and South Africa expanding cultivation to serve niche markets. Global trade policies, consumer preferences for organic and sustainable products, and shifts in logistics will continue to shape outcomes. Ultimately, producers that embrace innovation, sustainability, and branding will capture the lion’s share of future market growth, while those reliant on traditional approaches risk stagnation.

Policy & Business Recommendations: How to Maximize Economic Value

Maximizing the economic value of date exports requires coordinated action between policymakers and industry stakeholders. Governments should prioritize investment in infrastructure, including cold storage facilities, efficient transport networks, and modern processing plants. These improvements reduce post-harvest losses and ensure higher-quality exports that can meet stringent international standards. Policy frameworks must also support certification programs—such as organic, fair trade, and sustainability labels—which are increasingly demanded by premium markets. On the business side, producers and exporters should diversify their offerings beyond raw dates, focusing on value-added products such as syrups, date sugar, and packaged snacks that capture higher margins. Marketing and branding are equally critical: positioning dates as a superfood in health-conscious markets enhances global recognition and consumer loyalty. Collaboration through farmer cooperatives and public-private partnerships can help small producers access finance, technology, and global buyers. Moreover, investment in research and development—covering pest management, climate adaptation, and improved cultivars—ensures long-term sustainability. International trade negotiations should aim to reduce tariff and non-tariff barriers, improving access to high-value markets. By aligning policies with business innovation, producing nations can transform the date industry from a traditional agricultural sector into a globally competitive, sustainable, and high-value export powerhouse.

Conclusion: Balancing Growth, Value, and Sustainability

The future of the date export industry depends on finding the right balance between economic growth, product value, and long-term sustainability. While rising global demand presents lucrative opportunities, success will not be measured solely by export volumes. Instead, producing countries must focus on enhancing quality, building strong brands, and integrating sustainable practices into every stage of the value chain. The economic benefits are clear: job creation, rural development, and increased foreign exchange earnings. Yet these gains must be protected against threats such as climate change, resource scarcity, and market volatility. By embracing innovation in cultivation, logistics, and marketing, exporters can unlock new value while meeting the expectations of increasingly discerning international consumers. Equally, governments play a vital role in creating supportive policies that encourage private-sector investment, facilitate global market access, and safeguard environmental resources. As consumers turn toward natural and health-focused diets, dates are uniquely positioned to thrive as both a traditional and modern food commodity. In conclusion, the path forward lies in combining heritage with innovation—ensuring that date exports remain not only profitable but also sustainable, resilient, and beneficial to producing countries and global consumers alike.